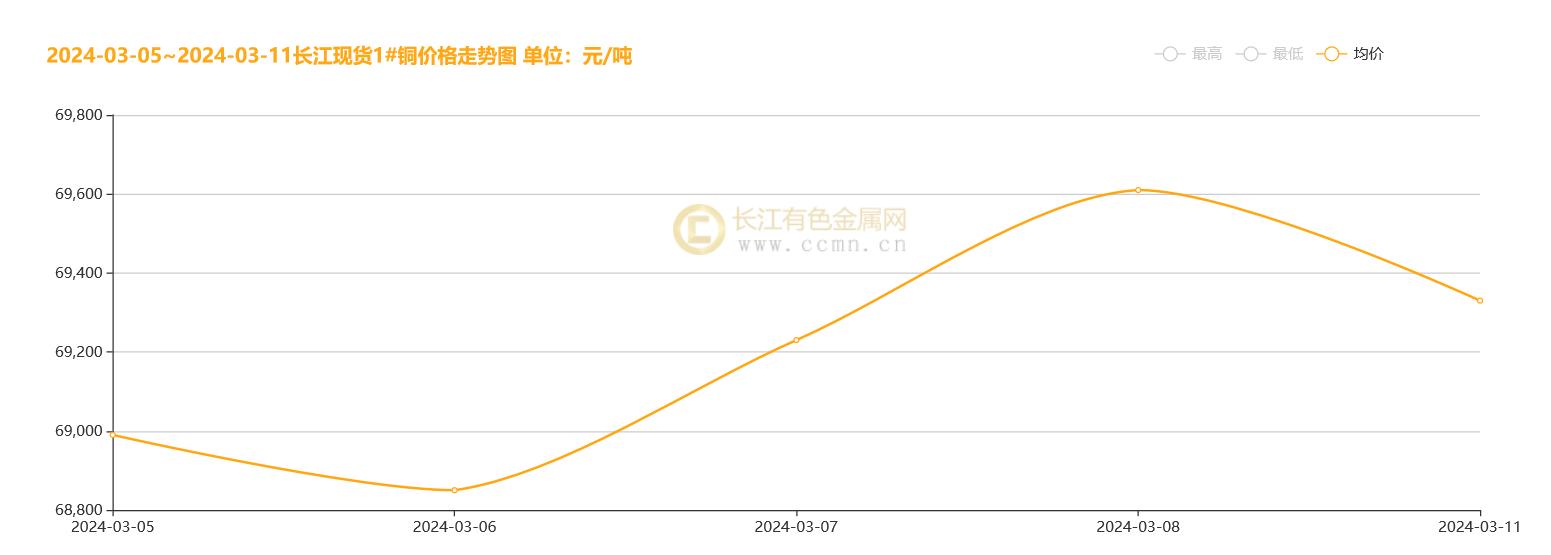

Monday Shanghai copper trend dynamics, the main month 2404 contract opened weaker, intraday trade disk showing a weak trend. 15:00 Shanghai Futures Exchange closed, the latest offer 69490 yuan / ton, down 0.64%. Spot trading surface performance is general, the market is difficult to see a large number of buyers, the downstream into the market purchasing enthusiasm is not high, mostly just need to replenish mainly, the overall transaction lack of bright spots.

Recently, the global copper market showed a stable situation. Although the supply disruptions at the mining end of the copper prices constitute a strong support, but the market sentiment is relatively stable, there is no significant fluctuations.

In the domestic market, investors for China's macro-stimulus policy this year with a neutral wait-and-see attitude. At the same time, the foreign market is increasing bets on the Federal Reserve's expected rate cut in June. This differential market sentiment reflects that the global copper market shows different reactions when facing the impact of different factors.

In the same U.S. economic data and interest rate hike expectations, the performance of mainstream assets but showed a different trend. This is further evidence of the complexity and uncertainty of the current market. Among them, the weak performance of the U.S. manufacturing and employment indicators in February triggered market concerns about the economic downturn. The market generally expects that the Federal Reserve may take measures to cut interest rates in the summer to stimulate economic growth. The dollar index fell in a row, boosting copper prices.

Powell, in his recent statement, emphasized the importance of the inflation target on the one hand, and on the other hand, he also paid attention to the changes in the actual economic environment. This balanced attitude reflects the Fed's caution and flexibility in formulating monetary policy. However, investors still need to be wary of the risk exposure of the US banking sector and possible adjustments to the pace of tapering, all of which could have a potential impact on the copper market.

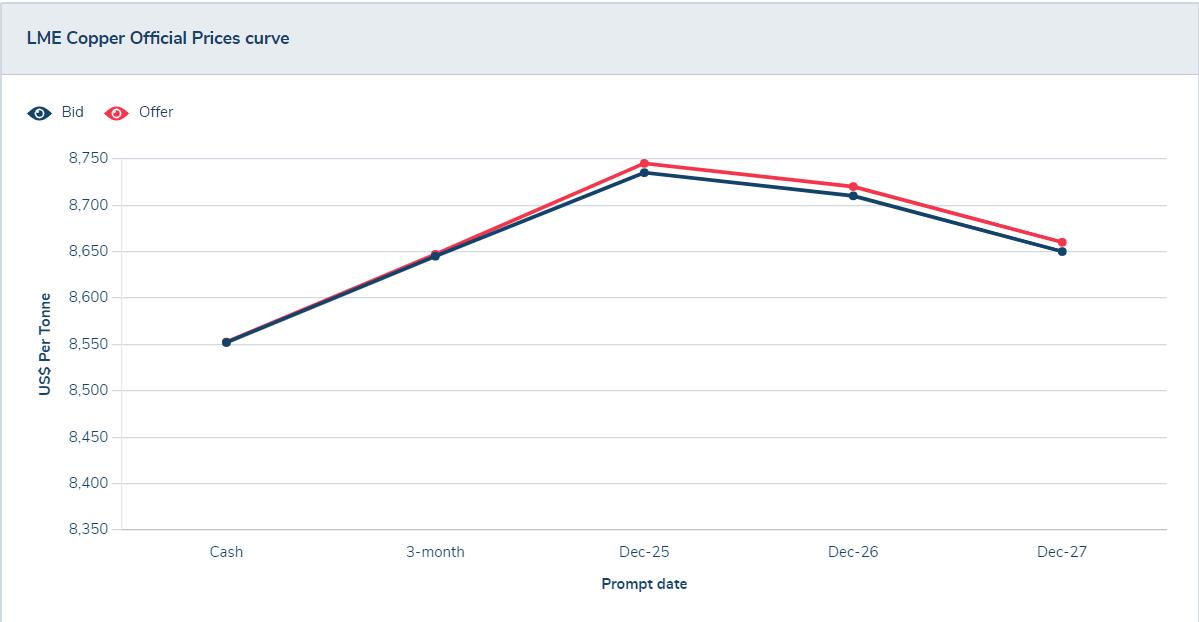

On the supply side, the disruption of supply at the mining end since last December has been a strong support to copper prices. This factor has not only depressed the profit margins of Chinese smelters, but may also further curb production. Meanwhile, the latest data released on Friday showed that LME copper stocks have fallen to the lowest level since September last year. This further enhances the upward momentum of copper prices, making the tight supply situation in the market more prominent.

However, on the demand side, the outlook for copper demand from the power, construction and transportation sectors is less than satisfactory. This has dampened market popularity to some extent. Analysts at a futures company pointed out that the consumption situation in China, the world's largest copper consumer, remains weak. While copper wire producers are at a higher-than-expected start-up rate, copper tube and copper foil producers are well below last year's levels. This difference and imbalance in demand for copper in different sectors makes the outlook for the copper market even more difficult to predict.

Taken together, the current copper market is showing a steady state of change. While factors such as supply disruptions at the mining end and declining inventories have supported copper prices, factors such as weak demand and macroeconomic uncertainty still have a potential impact on the copper market. Therefore, investors need to maintain a cautious and rational attitude when participating in copper market transactions and pay close attention to market dynamics and policy changes in order to make more informed investment decisions.

Post time: Mar-13-2024